Table of Contents

- Treatment of Title IV (Federal) Aid When a Student Withdraws

- How Withdrawal Date is Determined

- Order in Which Title IV Funds are Returned

- Time Frame for Return of Title IV Funds

- Credit Balances When a Student Withdraws

- Clarification of dates

Treatment of Title IV (Federal) Aid When a Student Withdraws

The law specifies how the Cleveland Institute of Music (CIM) must determine the amount of Title IV (Federal) program assistance that you earn if you withdraw from school. The Title IV programs that are covered by this law are Federal Pell Grants, Iraq and Afghanistan Service Grants, TEACH Grants, Direct Loans, Direct PLUS Loans, Federal Supplemental Educational Opportunity Grants (FSEOGs), and Federal Perkins Loans.

Though your aid is posted to your account at the start of each payment period (semester), you earn the funds as you complete the period. If you withdraw during your payment period, the amount of Title IV program assistance that you have earned up to that point is determined by a specific formula. If you received (or CIM or parent received on your behalf) less assistance than the amount that you earned, you may be able to receive those additional funds. If you received more assistance than you earned, the excess funds must be returned by CIM and/or you.

The amount of assistance that you have earned is determined on a pro rata basis. For example, if you completed 30% of your payment period, you earn 30% of the assistance you were originally scheduled to receive. Once you have completed more than 60% of the payment period, you earn all the assistance that you were scheduled to receive for that period.

If you did not receive all the funds that you earned, you may be due a post-withdrawal disbursement. If your post-withdrawal disbursement includes loan funds, CIM must get your permission before it can disburse them. You may choose to decline some or all of the loan funds so that you don’t incur additional debt. CIM may automatically use all or a portion of your post-withdrawal disbursement of grant funds for tuition, fees, and room and board charges (as contracted with CIM). CIM needs your permission to use the post-withdrawal grant disbursement for all other school charges. If you do not give your permission, you will be offered the funds. However, it may be in your best interest to allow CIM to keep the funds to reduce your debt at the school.

There are some Title IV funds that you were scheduled to receive that cannot be disbursed to you once you withdraw because of other eligibility requirements. For example, if you are a first-time, first-year undergraduate student and you have not completed the first 30 days of your program before you withdraw, you will not receive any Direct Loan funds that you would have received had you remained enrolled past the 30th day.

If you receive (or CIM or parent receives on your behalf) excess Title IV program funds that must be returned, CIM must return a portion of the excess equal to the lesser of:

- your institutional charges multiplied by the unearned percentage of your funds, or

- the entire amount of excess funds

CIM must return this amount even if it didn’t keep this amount of your Title IV program funds.

If CIM is not required to return all the excess funds, you must return the remaining amount.

For any loan funds that you must return, you (or your parent for a Direct PLUS Loan) repay in accordance with the terms of the promissory note. That is, you make scheduled payments to the holder of the loan over a period of time.

Any amount of unearned grant funds that you must return is called an overpayment. The maximum amount of a grant overpayment that you must repay is half of the grant funds you received or were scheduled to receive. You do not have to repay a grant overpayment if the original amount of the overpayment is $50 or less. You must make arrangements with CIM or the Department of Education to return the unearned grant funds.

The requirements for Title IV program funds when you withdraw are separate from the Refund Policy that CIM has for billed charges and institutional aid. Therefore, you may still owe funds to CIM to cover unpaid institutional charges. CIM may also charge you for any Title IV program funds that CIM was required to return.

If you have questions about your Title IV program funds, you can call the Federal Student Aid Information Center at 1-800-4-FEDAID (1-800-433-3243). TTY users may call 1-800-730-8913. Information is also available on Federal Student Aid on the Web.

As of the first day of classes, but before the end of the semester (payment period), if a student takes a Leave of Absence or Withdraws for any reason, the following policy dictates how Federal Student Aid must be adjusted, if applicable, on the student’s billing statement for that term.

Withdrawal prior to completing 60% of days of the semester, may result in a significant amount of federal student aid to be unearned (ineligible), and returned to the Dept. of Education. This may create a balance owed to CIM, even if the student had a zero balance prior to the withdrawal. Students may wish to consider purchasing private Tuition Insurance for this reason.

How Withdrawal Date is Determined

The official withdrawal date is determined by the CIM Registrar (registrarweb@cim.edu).

- Official Withdrawal: The student begins the CIM withdrawal process, or the student otherwise provides official notification to CIM of intent to withdraw. CIM requests the student submit the Withdrawal Form or Leave of Absence Form, as applicable. These forms are available from the Registrar’s Office.

The Withdrawal Date will be the date the student begins the withdrawal process, or the date that the student otherwise provides the notification (if both circumstances occur, the earlier is used as the withdrawal date). *

The Date of CIM’s Determination the Student has Withdrawn is the student’s withdrawal date or the date of the notification, whichever is later.

-

Unofficial Withdrawal: If official notification is not provided by the student due to circumstances beyond the student’s control, OR all other instances where the student withdraws without providing official notification.

The Withdrawal Date is the date that CIM determines is related to the circumstance beyond the student’s control. For all other instances, it is the midpoint of the payment period. *

The Date of CIM’s Determination the Student has Withdrawn is date that CIM has become aware that the student has ceased attendance.

If, at the end of a semester, a student has earned zero credits, CIM will attempt to verify if the student attended any class(es) or not. If no date of attendance may be documented, CIM must assume the student never attended.

*In place of the Withdrawal Date determinations listed above, CIM may always use the student’s last date of attendance at an academically related activity if the school documents that the activity is academically-related and that the student attended the activity.

The Return to Title IV Refund Policy is governed by the Department of Education. To view the Worksheet and formula used to calculate all Federal Student Aid adjustments due to mid-semester withdrawal, click here. This calculation is completed by the CIM Financial Aid Director upon receiving the official withdrawal date from the CIM Registrar’s Office. A copy of the completed Worksheet and detailed list of what, if any, federal aid must be adjusted will be sent to the student as soon as possible.

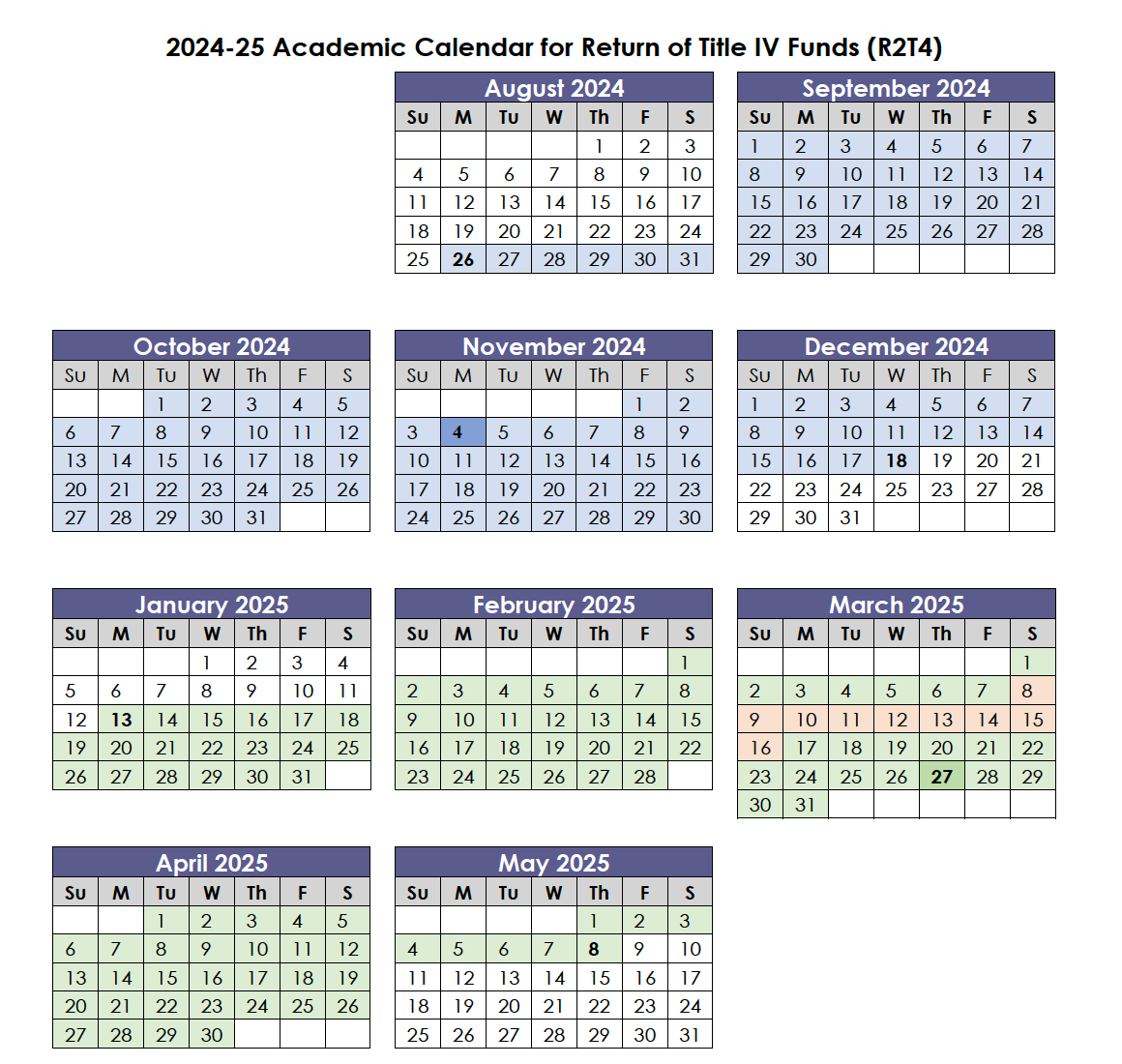

See the calendar later in this policy, 2024-2025 Academic Calendar for Federal Aid Refund Calculation (R2T4), for dates where a federal calculation is required each semester. The effective date of Withdrawal or Leave of Absence, as verified by the CIM Registrar, may create a significant balance owed to CIM.

The Federal Student Aid Refund calendar takes into account all days from the first day of classes through the last day of CWRU finals. Spring break in the spring semester does NOT count as days attended or in total days of the semester. Once a student has attended 60% of the actual days of the semester, there is no federal calculation and no federal aid needs to be returned. The 60% date is indicated for each semester. These federal aid review dates are significantly later than any tuition and/or scholarship adjustment would be made. If a withdrawal occurs prior to the aid disbursement date of a semester, there may be eligibility for some federal aid to be disbursed as a “post-withdrawal disbursement.” This will be explained as an option if it is applicable.

In addition, Federal Loan Exit Counseling instructions will be sent to the student within 30 days of the withdrawal date, if applicable.

Order in Which Title IV Funds are Returned

Per the mandatory Department of Education Treatment Of Title IV Funds When A Student Withdraws From A Credit-Hour Program” Worksheet, CIM must return the unearned aid for which the school is responsible by repaying funds to the following sources, in order, up to the total net amount disbursed from each source.

- Unsubsidized Direct Loan

- Subsidized Direct Loan

- Direct PLUS (Graduate Student)

- Direct PLUS (Parent)

- Pell Grant

- Federal Supplementary Educational Opportunity Grant (FSEOG)

Time Frame for Return of Title IV Funds

Funds that are to be returned to the Department of Education must be sent as soon as possible, but no later than 45 days after the date CIM determined the student withdrew.

If the student is eligible for a post-withdrawal disbursement, such notification will be provided to the student within 30 days of the date the school determined the student had withdrawn. If a post-withdrawal disbursement is applicable to the student’s account, such payment must be made as soon as possible, but no later than 180 days after the date CIM determined the student withdrew, in accordance with requirements for disbursing Title IV funds 34 CFR 668.164.

Similarly, if there is a grant overpayment to report, the student will be notified within 30 days of the date the school determined the student withdrew.

Credit Balances When a Student Withdraws

The school must determine the correct Title IV credit balance, taking into account the results from the Return to Title IV calculation, the institutional refund calculation, and state aid refund calculations, as applicable. If after those adjustments, if applicable, are posted to the student’s account and a credit balance results, the credit balance will be disbursed via a check to the student as soon as possible but no later than 14 days after the date of the Return to Title IV calculation is performed. If the credit balance is the result of a Direct PLUS Parent Loan, the refund check is issued to the parent, unless they had designated the student to be the recipient of any excess funds on the PLUS Loan application. The check will be mailed to the student or parent permanent address if the student is no longer in Cleveland.

Clarification of dates

Per the calendar below, each semester’s detail needed to “earn” the awarded federal aid (60% of days of the term) is as follows:

Fall classes begin 8/26/24. End date of term is last date of CWRU finals, 12/18/24. To “earn” all aid for the semester, the student must attend at least 60% of the semester, which is through November 4, 2024.

Spring classes begin 1/13/25. End date of term is last date of CWRU finals, 5/08/25. March 8-16 is Spring Break and those days do not count as days of the term. To “earn” all aid for the semester, the student must attend at least 60% of the semester, which is through March 27, 2025.

Blue = Fall 2024 term; 115 days total (60% of days to fully earn all federal aid = 69 days attended = November 4).

Green = Spring 2025 term (orange is spring break/days do not count); 107 days total (60% of days to fully earn all federal aid = 65 days attended = March 27).

If for any reason the dates of a semester or scheduled breaks change, this policy will be updated, as applicable.